Why Traditional Methods Are No Longer Enough

For decades, asset performance was assessed using backward-looking data such as historical lease performance, tenant financials, and occupancy reports. But the market is evolving too fast for these models to keep up. Factors like the rise of hybrid work, shifts in commercial space usage, and macroeconomic uncertainty make it harder to assess asset health in real-time. Gut instinct and static reports can no longer carry the weight of multi-crore investments.

AI steps in as a predictive intelligence engine, spotting risks before they’re visible on balance sheets or site inspections.

Insights You Can’t Afford to Miss

AI doesn’t just automate it illuminates. Here’s how predictive analytics is creating a new tier of visibility for asset managers:

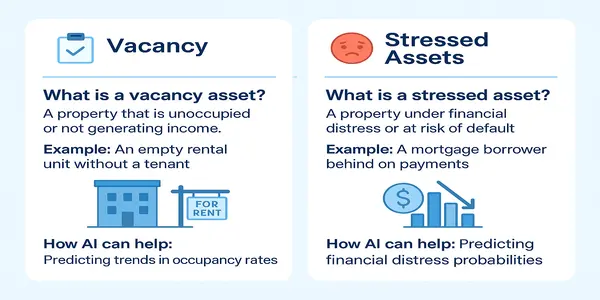

1. Vacancy Risk Forecasting

AI systems analyze footfall patterns, lease churn probabilities, tenant credit data, and market sentiment to forecast which properties may face extended vacancy.

Benefits include:

- Proactive tenant retention efforts

- Pricing adjustments before market shifts

- Alternative space utilization planning

2. Stressed Asset Identification

Some properties decline gradually due to deferred maintenance, tenant dissatisfaction, or neighborhood shifts.

AI detects these stress signals using:

- Maintenance logs

- Delayed rent payments

- Tenant complaints

- Nearby business closures

What appears stable on paper may already be deteriorating beneath the surface.

3. Demand-Supply Micro-Mapping

AI enables hyper-local analysis by mapping demand against upcoming supply, construction timelines, and economic indicators. Asset managers gain sharper context for acquisitions or divestment decisions.

4. Early Lease Termination Signals

Tenants may signal exit intentions before formally notifying landlords. AI monitors cues like:

- Reduced space utilization

- Declining employee headcount

- Changes in tenant market performance

This provides early warnings to mitigate downtime and lost revenue.

The Commercial Investor’s Blind Spot

AI is indispensable because it sees patterns humans cannot—hundreds of leases, subtle shifts in tenant behavior, and predictive vacancy trends. These insights are measurable, trackable, and actionable, offering a strategic advantage for investors managing complex portfolios.

Asset Managers: This Is Your Advantage Window

Currently, only a subset of asset managers use AI-backed analytics to refine their strategies. Early adopters are optimizing performance, de-risking better, allocating smarter, and exiting before markets turn. As AI matures, today’s competitive edge will become tomorrow’s baseline.

What AI Doesn’t Replace And What It Enhances

AI amplifies human experience and judgment, allowing asset managers to:

- Validate assumptions with multi-dimensional data

- Compare properties beyond surface-level metrics

- Respond faster to vacancy risks or distressed asset signals

- Prioritize capital toward high-performing zones or tenants

For diverse or expanding portfolios, relying only on quarterly reporting or manual review is no longer practical.

How Trythat.ai Integrates AI for Commercial Real Estate

Platforms like Trythat.ai go beyond intuitive, chat-based search. By layering AI into property data, it:

- Cross-checks listings across sources

- Translates documents for better analysis

- Maps user preferences for predictive insights

This creates continuity across the lifecycle from investor dashboards to tenant search journeys.

Final Thought: Predict, Don’t React

In commercial real estate, resilience comes from responsiveness, which requires foresight. AI turns noise into signals, and signals into action. Whether evaluating commercial space for rent, managing occupancy trends, or searching for high-performing acquisitions, predictive analytics can be your most valuable ally. In this market, success depends not on seeing vacancies, but on seeing them coming.